How long will this last?

History doesn’t repeat itself, but it often rhymes. We all remember Tony Blair saying this is not a time for soundbites and then launching into a soundbite. Can I apologise if I fail also to follow his advice?

History doesn’t repeat itself, but it often rhymes. We must understand what has happened before to inform our perception of what happens next and what decisions should be made to protect and enhance our financial plans.

The major financial events of the last century are chronicled on the wall of both our meeting rooms and I know many of you will have discussed how historical events have impacted investment returns.

It is useful to understand how markets work, while remembering all portfolios also have diversification into fixed interest, real assets and cash.

Stock markets are called markets because they are effectively a trading place for people to buy and sell their share of a company’s value. The price is established at the point where buyers and sellers are both content to trade. If there are more buyers than sellers then the price goes up to a point where an equilibrium is reached. Recently there have been more sellers than buyers and hence values go down.

It is understandable when there is worry and uncertainty buyers are scarce and hence falls in value continue until buyers see value, enough for them to trade. When worry reduces, buyers see value ahead and the price moves upwards to meet increased demand for shares.

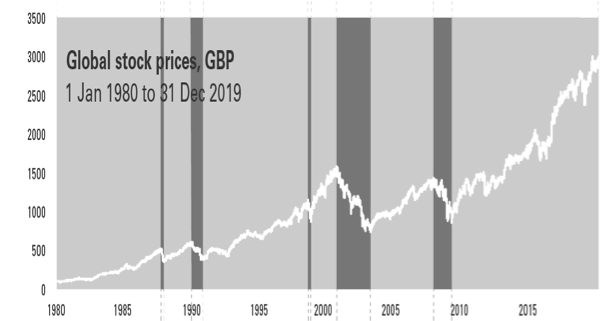

For those who like analysis and charts there is a graph below which shows the market falls of the last 30 years and the recovery period. This shows the longest period for recovery is 30 months and averages are much lower. Now, I am not ready for predictions but the systemic damage through a clogging up of trade through the pandemic feels less permanent than the loss of confidence in the value of assets during the financial crisis of 2008.

The outcome is certain though to be a huge increase in Government debt in most economies, so get ready for tax rises when this is all over.

Most important is having income or cash to spend while any recovery happens. This is a massive part of having a robust financial plan and why these falls should not be a worry with a sensible long term plan. Missing out on the recovery when it happens is perhaps more damaging to clients.

We have compared our middle of the road investment approach to the FTSE All share to show how diversification helps dampen losses. This is not a fair comparison but is intended to demonstrate the benefits of not having all eggs in one basket.

We remain available to talk through these principles to clients as well as their friends and family if we can help understand the implications of today’s financial events.

So how long does it take?

Vanguard has produced the following chart which shows Bull and Bear market figures for the last 30 years.

Leave a Reply

Want to join the discussion?Feel free to contribute!